How Can Recent Government Spending Be Described

The united States government spending includes expenses such as pensions health care education defense welfare protection transportation interest and others. How can recent government spending be best described.

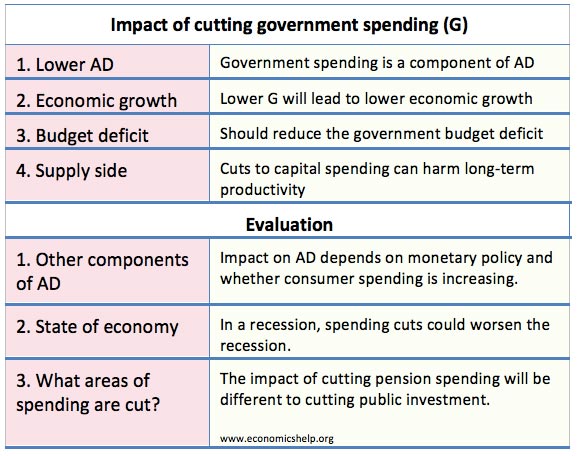

Impact Of Cutting Government Spending Economics Help

Over one recent 18-month period Air Force and Navy personnel used government-funded credit cards to charge at least 102400 on admission to entertainment events 48250 on gambling 69300 on.

. The percentage was about the same for 2019. If government spending is financed by higher taxes then tax rises may counter-balance the higher spending and there will be no increase in aggregate demand AD. The effectiveness of fiscal policy in stimulating demand depends on the type of policy and how much immediate spending it produces.

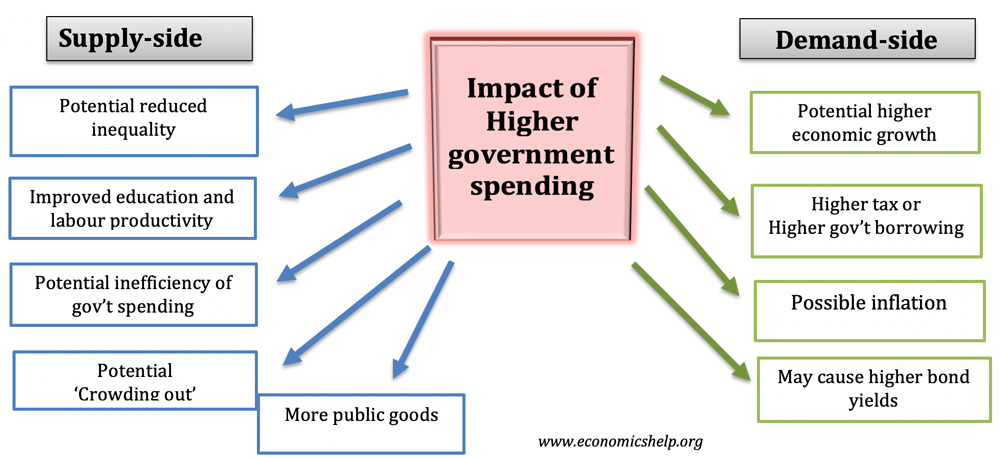

Government purchases expenditures represent total government spending including goods services grants to state and local governments and transfer payments since the 1950s total government expenditures as a percentage of GDP have increased decreased and total government purchases as a percentage of GDP have increased decreased. Increasing taxes and increasing government spending by the same amount. Capital spending They are for the long term and do not need to be renewed each year.

The increased government spending noted in Q31. Also called social capital they include spending on physical assets like roads bridges hospital buildings and equipment. Based on progressive goals D.

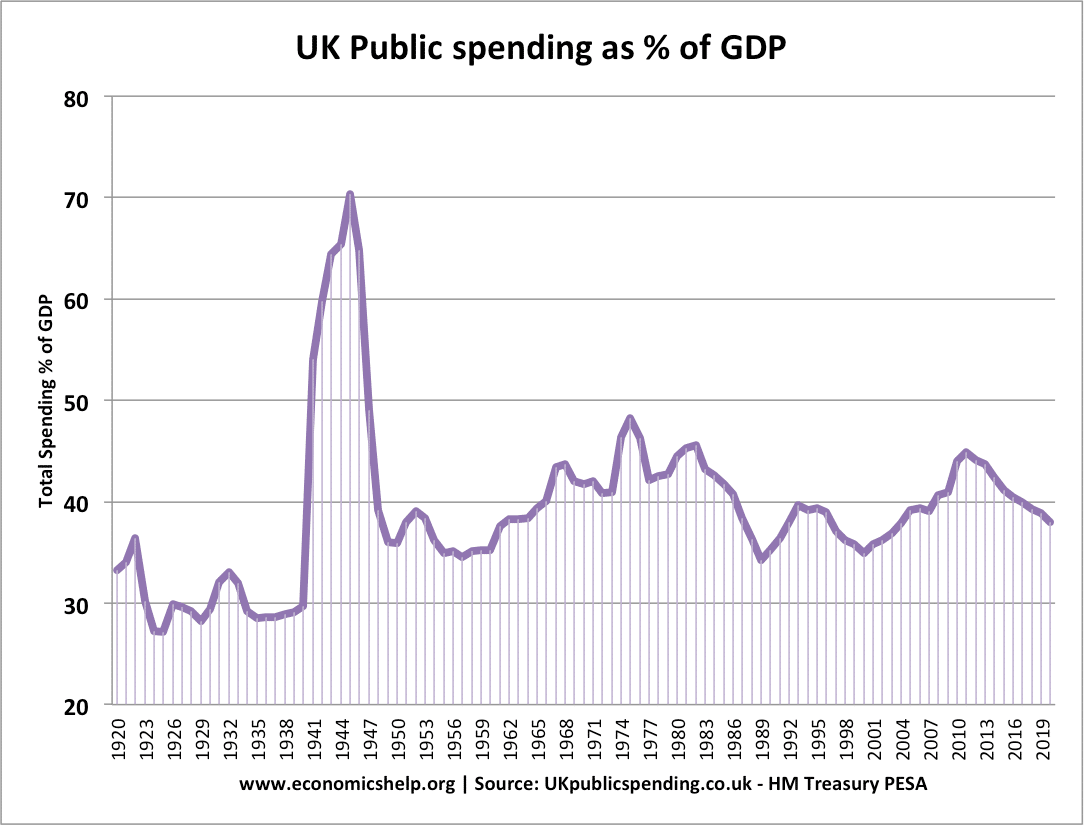

Increasing taxes while holding government spending constant. In 1945 the federal government spent 927 billion and ran a deficit of 215 of GDP. 1 Thats the federal budget for the fiscal year 2021 covering October 1 2020 through September 30 2021.

In this entry we study public spending through the lens of aggregate cross-country data on government expenditures. Views hold that one of the most significant policy mistakes in recent times was a premature shift to this policy termed fiscal consolidation. For example due to aggressive welfare and foreign policies programs United States Debt under President Obamas supervision has increased for about 9 Trillion.

Based on progressive goals. Which of the following is an example of expansionary fiscal policy. Safeguard resources needed for future production.

Or 3 print money. In a surprisingly short time the government might be spending more than it was during the days of big deficits. 1 raise current taxes.

Suppose a government proposes to spend an additional dollar of spending. Fiscal policy is conducted by the government and aims at boosting the economy. All of these expenses have increased over the last decade while the governments revenue has remained constant.

One paper found that over three-quarters of developed countries have. Used only for public good C. When the economy goes into recession deficit spending through tax cuts or the purchase of goods and services by the government can stop the downward spiral and help to turn the economy back around.

Recent government spending be best described as. Types of Spending 1. So overall income tax.

Its 207 of gross domestic product according to the Office of Management and Budget Report for FY 2021. Income tax made up 55 of the 85. In 2020 individual and payroll tax revenue accounted for 85 of the governments revenue.

Todays conventional economics says there are three means of financing that proposal. Balanced with revenues D. The most amount of deficit in United States history.

In developed countries limiting the size of government can help the economy grow faster. Ways of Financing Government Spending Old and New. Constitution can best be described as a plan describing the organization and operation of a central government.

Public goods can best be described as benefits and services. Used only for public good. Federal Reserve tightened monetary policy to.

Every morning the public wakes up to articles from the Associated Press the Washington Post and the New York Times that can best be. Hasty movements of money into and out of a countrys economic system. It depends on how government spending is financed.

Constantly increasing O C. Studies explicitly looking at the non-linear relationship between government size and growth typically find that government spending hurts growth after it exceeds 25-30 percent of GDP. Government spending grants to the states or transfers such.

Describe three ways in which government spending can be financed. 2 raise future taxes by issuing current debt. Balanced with revenues B.

How can recent government spending be best described. How can recent government spending be best described. This is when the government spends.

Tamaranim1 39 10 months ago. Current spending They are for the short term and include expenditure on wages and raw materials. On March 11 2022 Congress passed a 15 trillion omnibus spending package to fund the government through September 2022.

June 11th 2014 by Edward Lopez. Increasing government spending while holding taxes constant. The legislation contains a separate amount of 136 billion in.

The countrys GDP dropped by 22 and unemployment peaked at roughly 6 as the government wound down security spending following the war and the US. Above has to be financed in one way or another. Public spending enables governments to produce and purchase goods and services in order to fulfil their objectives such as the provision of public goods or the redistribution of resources.

It also sets state and central government powers apart. Government spending is 4829 trillion. If the economy is close to full capacity higher government spending can lead to crowding out.

What do capital controls prevent.

Government Spending Definition Sources And Purposes

No comments for "How Can Recent Government Spending Be Described"

Post a Comment